There’s an interesting review of Jagdish Bhagwati’s book Protectionism published in the year 1988 by Wynne Godley in the journal Economica, year 1993. Without going into the review, I wanted to highlight how Wynne Godley’s views were quite similar to Nicholas Kaldor’s and Godley proposals such as planned trade and international cooperation of a new kind:

… Kaldor’s chapter, ‘The Foundations of Free Trade Theory and Their Implications for the Current World Recession’ (in E. Malinvaud and J. P. Fitoussi (eds.), Unemployment in Western Countries, 1980), which, in the context of a fundamental critique of the abstract theory of international trade, suggests that, because of the scope for dynamic economies of scale, free trade in manufactured goods leads to the concentration of manufacturing production in certain areas, what Kaldor called ‘a polarisation process’. ‘In principle such trade is of great practical benefit since specialisation between industries of different areas should enable the benefits of the economies of scale to be realised more fully. However … this … depends on the trade being balanced in both directions … But as past experience … has shown this does not come about naturally.’

These ideas were further developed in Kaldor’s 1981 article in Economie Appliquee, ‘The Role of Increasing Returns, Technical Progress and Cumulative Causation in the Theory of International Trade and Economic Growth’, where he related his concern about dynamic imbalances in trade to the ideas of Roy Harrod (himself a strong advocate of protection as a way of improving Britain’s economic performance throughout the postwar period), who had put forward the theory of the foreign trade multiplier in his International Economics (1933). As the trade imbalances constituted a growing threat to the continued expansion of the world economy, Kaldor concluded that we should not ‘stick to free trade (whatever the cost) but introduce a system of planned trade between the industrially developed countries on a multilateral basis’.

Also in an interview to the magazine Marxism Today in 1981, Wynne Godley says how he is openly opposed to free trade and the destructive aspect of it:

Let’s turn to some international questions. How do the problems of the UK economy — and your solutions to them — tie in with problems in the world economy?

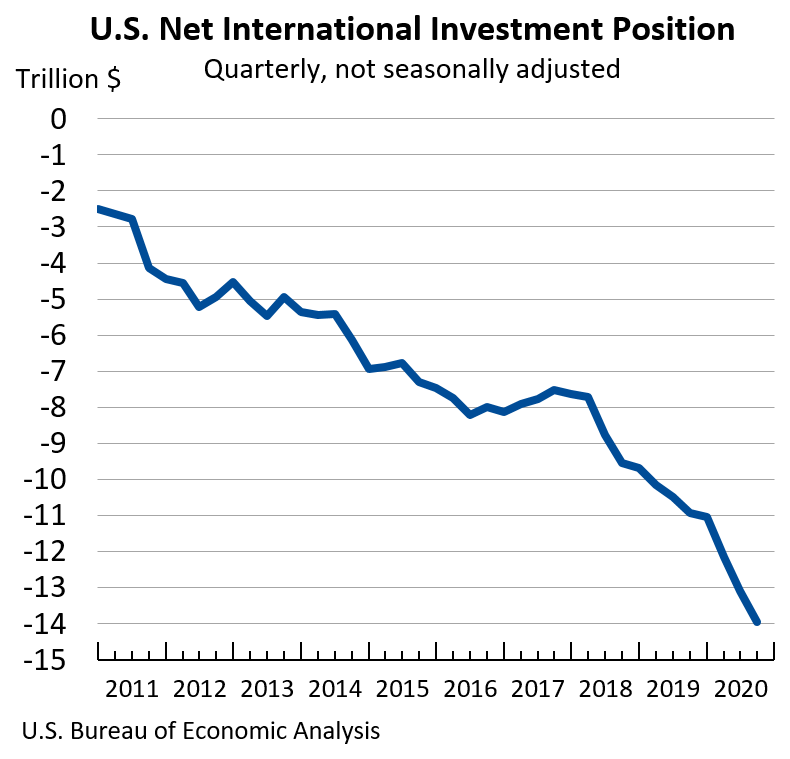

Well, the general answer is that I don’t think that free trade is the best way of organising international trade. The classical theory of international trade, which appears in text books and which is extremely influential in peoples’ minds, is based on a postulate of full employment. If you assume full employment you can easily prove that free trade is mutually advantageous. But if you think, as I do, that full employment cannot be assumed, then it’s easy to make out a realistic case that free trade is extremely destructive to economies that are relatively unsuccessful. Instead of making them more prosperous and better-off, it destroys them. I think this is a general proposition; it applies to the United Kingdom at the moment because it’s a relatively unsuccessful country, and I think it is beginning to apply to the United States, which is also becoming a relatively unsuccessful country.

When you say that you think that the free trade system is a bad system, how do you think it should be changed? It’s easy enough to say Britain should have import controls, but how do you see this in international terms?

Well, the logical answer to the question which, as an academic, is what I am primarily called on to give, is quite clear to me. If all relatively unsuccessful countries protect in the way we suggest — using import controls to raise domestic output and not to strengthen their balance of payments — the system of protection can be generalised advantageously. But that assumes a high degree of international co-operation, and international co-operation of a new kind.