The New York Times On Automation

The Editorial Board of The New York Times have written an editorial in “The Opinion Pages” stating that they don’t see automation as something taking away jobs.

The article also rightly says:

Americans should blame policy makers, not robots.

While that’s great—good start—the article errs on trade:

Defenders of globalization are on solid ground when they criticize President Trump’s threats of punitive tariffs and border walls. The economy can’t flourish without trade and immigrants.

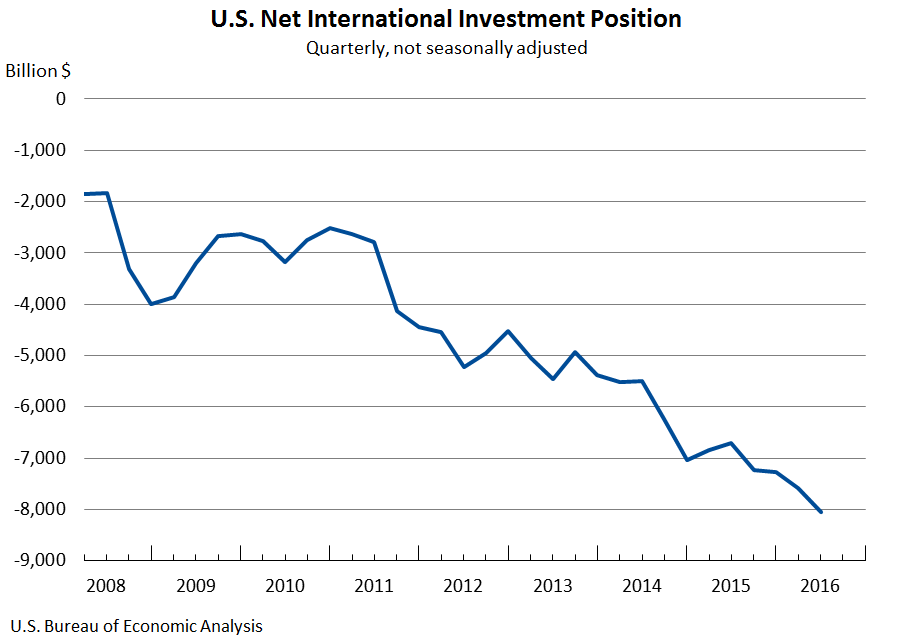

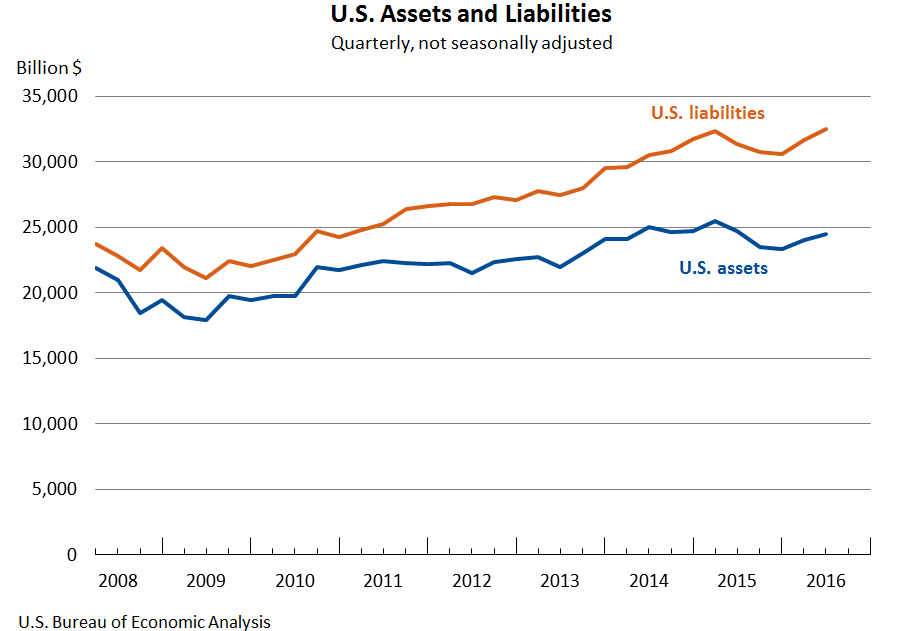

It’s a bit of a straw man argument to claim that anyone opposed to free trade is opposed to trade itself. The U.S. trade imbalance is a problem for employment. Globalization has also led to offshoring of jobs. Immigration control can be used for economic migration without discrimination to help workers both in employment and wage bargaining. The principle of non-refoulement should be respected and all refugees should be allowed.

[the header of this post is the link]