Dani Rodrik On Globalisation After COVID-19

Suppose a poor isolated country opens to business to the rest of the world. There is high risk that producers in that country file for bankruptcy because of competition from foreign producers. Hence the poor country might look at various ways of integrating, such as protection of its industries.

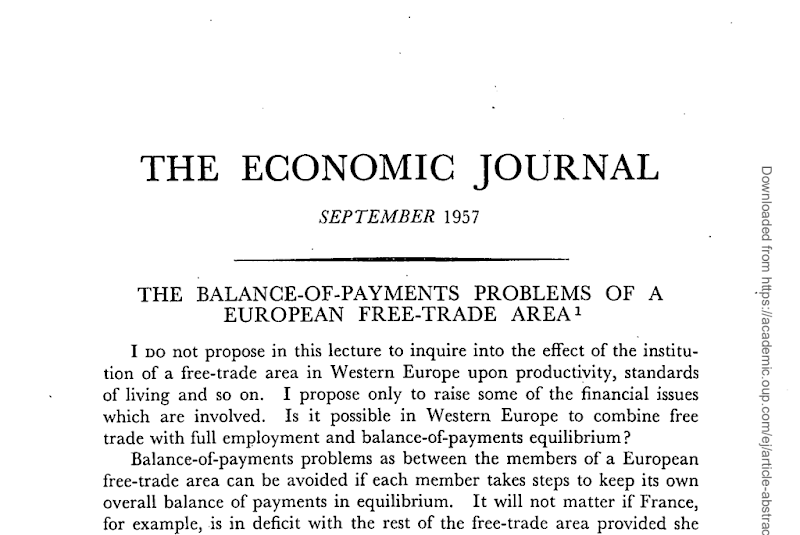

In Post-Keynesian theory, success and failures of nations are strongly the result of performance of corporations in world markets. Winners keep winning and those are left behind keep struggling. Free trade destroys countries.

Of globalisation isn’t just about trade but also finance. So one pet peeve of activists against globalisation is the investor rights agreements which gives corporations power over national governments. And globalisation is also about movement of people for employment and business.

Dani Rodrik is a mainstream economist but his views are on the dissenting edge of mainstream, so he is interesting despite his shortcomings.

So for example, he realises that the rules of the game of globalisation is the result of rigging by top corporations but then claims that the economics profession is innocent:

Political settlements are the joint product of vested interests and prevailing ideas. Our present system of globalisation is no different. After the Bretton Woods regime ran aground with the oil shocks of the 1970s, many developing nations proposed a new mode of integration organised through the UN agencies. But in the end the west and its allies pushed through rules that served the interests of large corporations, financial markets, and skilled professionals quite well, but did not do much for others—those who did not have the networks, skills, or assets to profit from global markets. Had there been powerful lobbies pushing for global co-operation over public health or the environment—and had those in power not bought into the misguided belief that “mainstream” economics dictated they pursue economic efficiency over every other priority, and ever-freer trade as an end in itself—then we might have erected one of the other types of globalisation I just sketched.

On “open-borders”, he rightly dissents from the mainstream view:

A complete opening of borders to foreign labour is neither feasible nor desirable.

Although Rodrik’s ideas are a break from “mainstream”, it doesn’t go too far. Post-Keynesians stress outcome based rules such as balance-of-payments targets via asymmetric protectionism where poor countries are allowed a mix of higher industrial policy and protectionism without facing retaliation and creditor countries being required to boost domestic demand, remove import restrictions and lend to poor countries at cheap interest rates. All this with a coordinated fiscal expansion which maintains economies at full employment.