Doug Henwood In Jacobin On Neochartalism

On Facebook, Doug Henwood says that he wanted the title The Phantasmic World Of Modern Monetary Theory, A Late Imperial Fever Dream for his piece critiquing Neochartalism but Jacobin editors changed it to Modern Monetary Theory Isn’t Helping.

Henwood has written an excellent critique of Neochartalism, a cut above most critiques. I liked the part about Beardsley Ruml who is quoted frequently by the Chartalists but it turns out that he is a right-wing nut, against taxes 😁

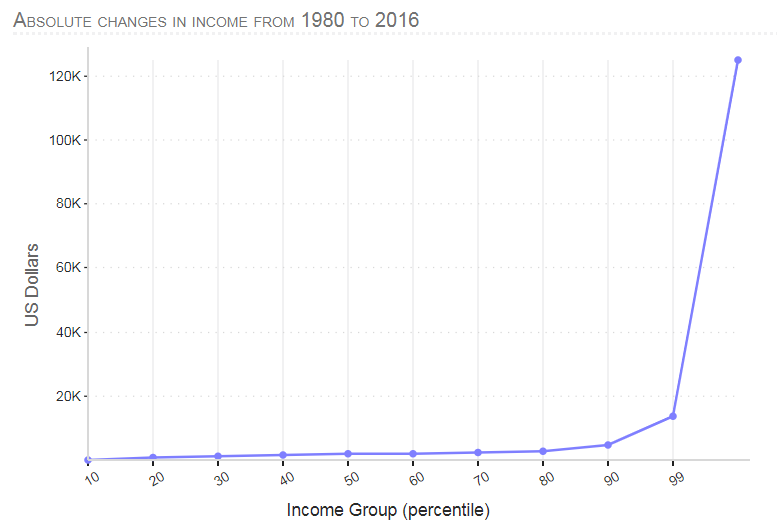

It’s important because as Henwood argues in this piece, Neochartalists do not seem to want high taxes. In my view they get deceived by their own rhetoric.

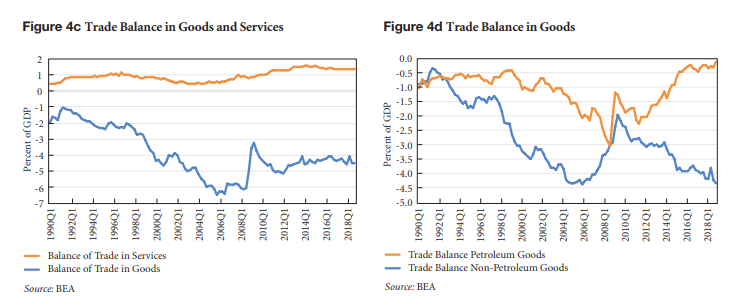

And the article contains an important discussion of Turkey, highlighting how Neochartalists avoid discussion of balance of payments problems:

When I asked Mosler what MMT had to offer Turkey, a country whose currency has been losing value for the last four years and had something of a financial crisis in the summer of 2018, he responded with a bit of avian whimsy: “Without our recipe for Turkey they’re a dead duck.”

However this recommendation to read his article shouldn’t be taken as an endorsement of all of Henwood’s views. Fiscal policy supremely matters. Just not the Neochartalist way. Henwood seems to not understand the importance. The cover of the issue is silly, as Bernie Sanders himself does soft imperialism.