Unsustainable Processes Of The EU

Stephen Kinsella on his new web app:

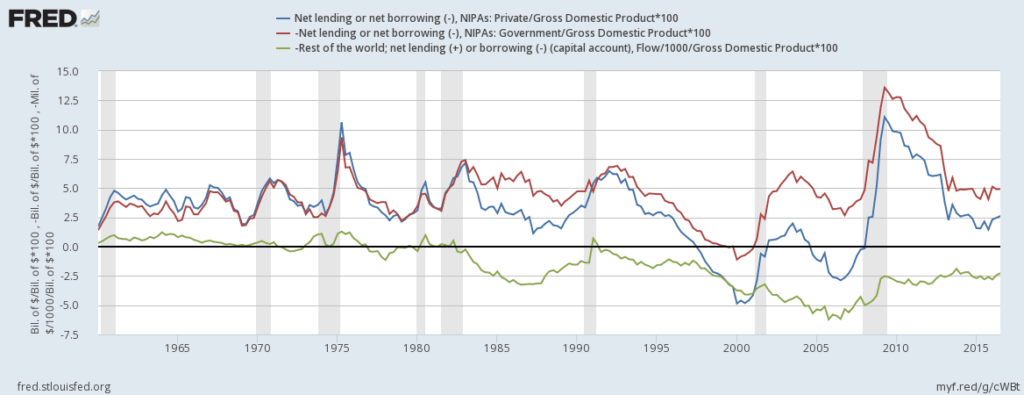

Wynne Godley’s Seven Unsustainable Processes (1999) examined the medium-term prospects for the US economy. It shows that in the United States, growth in that period was associated with seven unsustainable processes related to fiscal policy, foreign trade and payments, and private saving, spending, and borrowing. Given unchanged US fiscal policy and growth in the rest of the world, in order to maintain growth, the excessive indebtedness implied by these processes would be so large as to create major problems for the US economy and the world economy in the future. Godley was right. This web application aims to replicate Godley’s analysis for all of the countries in the EU, to see whether or not these unsustainable processes can be seen. It goes beyond Godley in forecasting each important ratio. The accompanying paper gives full details of the ratios and their construction.

[The post title is the link]